Earning an online associate degree is a powerful step toward career advancement and higher education, but the question of how to pay for it can feel daunting. The good news is that a robust ecosystem of financial support exists specifically for distance learners. From federal grants that don’t require repayment to employer tuition assistance programs and scholarships designed for non-traditional students, the pathways to funding your education are more accessible than many realize. Understanding how to navigate and combine these resources is the key to making your educational goals financially feasible without incurring overwhelming debt.

Understanding the Foundation: Federal and State Aid

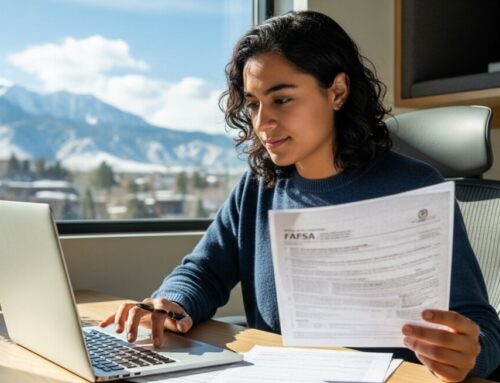

The first and most critical step for nearly every student seeking online associate degree financial support is completing the Free Application for Federal Student Aid (FAFSA). This single form is your gateway to the largest source of financial aid in the United States, including grants, work-study, and federal student loans. It is a common misconception that online students are ineligible for federal aid. As long as you are enrolled in an accredited online associate degree program at a Title IV-eligible institution (meaning the school can distribute federal aid), you have the same right to apply as on-campus students. The FAFSA determines your Expected Family Contribution (EFC), now known as the Student Aid Index (SAI), which schools use to craft your financial aid package.

State governments also offer significant financial support, often through need-based grants. Eligibility typically requires state residency and enrollment in an in-state public college, though some states have reciprocity agreements. These grants are frequently first-come, first-served, making early FAFSA submission even more crucial. Your chosen school’s financial aid office will automatically consider you for state aid when processing your FAFSA data. It is essential to verify that your online program is approved for state aid in your state of residence, as rules can vary. For a deep dive into starting this process, our resource on completing your FAFSA form for online associate degree financial aid provides a step-by-step walkthrough.

Grants and Scholarships: Free Money for Your Degree

Grants and scholarships represent the ideal form of online associate degree financial support because they do not need to be repaid. Distinguishing between the two is simple: grants are primarily need-based, while scholarships are typically awarded based on merit, background, or field of study. The Federal Pell Grant is the cornerstone of need-based aid for undergraduate students. For the 2023-2024 award year, the maximum Pell Grant was $7,395, and eligibility is determined solely by your FAFSA. Many states have analogous grant programs. Furthermore, the Federal Supplemental Educational Opportunity Grant (FSEOG) provides additional aid to students with exceptional financial need, though funding is limited.

Scholarships for online students are abundant and often underutilized. They are offered by colleges themselves, private foundations, community organizations, and professional associations. When searching, use keywords like “online student,” “distance learning,” “non-traditional student,” “adult learner,” and your specific major. Many scholarships target students pursuing degrees in high-demand fields like healthcare, information technology, or skilled trades. Creating a systematic approach to scholarship applications can yield significant returns. Here is a list of common scholarship sources for online associate degree seekers:

- Institutional Scholarships: Offered directly by the college or university, often based on academic achievement, residency, or program enrollment.

- Employer and Union Scholarships: Many companies and labor unions offer scholarships for employees, members, or their dependents.

- Community Foundation Scholarships: Local foundations manage funds for residents of specific counties, cities, or states.

- Demographic or Affiliation Scholarships: Awards for veterans, military families, first-generation students, or members of specific ethnic or cultural groups.

- Career-Specific Scholarships: Provided by professional associations to encourage entry into fields like nursing, engineering technology, or paralegal studies.

Dedicate time each week to search and apply for scholarships. Even small awards add up and reduce the amount you may need to borrow. Remember, scholarships are not just for high school seniors, adult learners are a key demographic for many awards.

Leveraging Employer Tuition Assistance and Payment Plans

For working adults, employer tuition assistance (ETA) is one of the most valuable yet overlooked forms of online associate degree financial support. A 2023 survey by the International Foundation of Employee Benefit Plans found that over 80% of employers offer some form of undergraduate tuition assistance. These programs are designed to upskill the workforce, and an associate degree in a relevant field often qualifies. Benefits may cover a specific dollar amount per year (e.g., $5,250, which is the common IRS tax-free limit) or a percentage of tuition costs. Some companies have partnerships with specific online universities, offering discounted tuition rates.

It is imperative to understand your company’s policy, which often includes a grade requirement (like maintaining a “B” average) and a service commitment to remain with the company for a period after receiving the funds. If your current employer does not offer a program, consider discussing the possibility, framing it as an investment in your long-term contribution to the company. Alongside ETA, most colleges offer tuition payment plans. These plans allow you to spread the cost of a semester over several monthly installments, often with a small enrollment fee but no interest. This can be a lifesaver for managing cash flow without taking out additional loans. Combining an employer contribution with a payment plan can cover a substantial portion, if not all, of your direct educational costs.

Federal Student Loans: A Tool for Responsible Borrowing

When grants, scholarships, and work income are not sufficient to cover all costs, federal student loans become a component of a comprehensive financial support plan. They are a tool that must be used wisely. Federal loans for undergraduates come in two main types: subsidized and unsubsidized. Subsidized loans are need-based and have a significant advantage: the U.S. Department of Education pays the interest while you are in school at least half-time and during grace and deferment periods. Unsubsidized loans are not need-based, and interest accrues from the time the loan is disbursed. For an online associate degree, you are typically limited to annual and aggregate loan amounts that are lower than those for bachelor’s degree students.

The key to responsible borrowing is to only take what you absolutely need. First, accept all free aid (grants and scholarships), then consider federal work-study or part-time work, and use loans as a last resort to fill the gap. Always borrow federal loans before considering private student loans, as federal loans offer superior borrower protections, including income-driven repayment plans, deferment options, and potential loan forgiveness programs. Before accepting any loan, use a loan calculator to estimate your future monthly payments. A general rule is that your total student loan debt at graduation should not exceed your expected starting annual salary. For clear guidance on navigating these decisions, our article on essential FAFSA tips for online associate degree students covers loan acceptance strategies in detail.

Tax Benefits and Cost-Saving Strategies for Online Students

Beyond direct aid, the U.S. tax code provides benefits that can effectively reduce the net cost of your education. The American Opportunity Tax Credit (AOTC) is particularly valuable for associate degree students. It allows you to claim a credit of up to $2,500 per year for qualified education expenses (tuition, fees, course materials) for the first four years of post-secondary education. A tax credit directly reduces the amount of tax you owe, dollar-for-dollar. Alternatively, the Lifetime Learning Credit (LLC) offers up to $2,000 per tax return for a wider range of educational pursuits, including courses to acquire or improve job skills, and has no limit on the number of years you can claim it. You cannot claim both credits for the same student in the same year, so consult a tax professional to determine which is best for your situation.

Proactive cost-saving strategies can dramatically shrink your tuition bill. The most direct is attending a public community college or state university in your state of residence, as in-state tuition rates are significantly lower than out-of-state or private college rates. Many states have unified online systems, like California’s Online Community College or Colorado Online, offering in-state rates to residents. Another powerful strategy is credit for prior learning. Many schools award college credit for passing scores on CLEP or DSST exams, professional certifications, military training, or portfolio assessments of work experience. Earning even 15 credits this way (half a typical associate degree) can save you a semester’s worth of tuition and time. Finally, ensure your chosen online associate degree program is regionally accredited. This not only guarantees educational quality and transferability of credits but is also a strict requirement for receiving federal financial aid and many forms of college degree information.

Frequently Asked Questions

Q: Can I get financial aid if I am only attending online classes part-time?

A: Yes, but your enrollment status affects the amount. You must be enrolled at least half-time (typically 6 credit hours per semester) to qualify for federal Direct Loans. Some grants, like the Pell Grant, can be prorated for less-than-full-time enrollment, but others may require full-time status. Always check with your school’s financial aid office.

Q: Do I have to pay back grants if I withdraw from my online classes?

A: Potentially, yes. Federal and state grants are awarded with the expectation you will complete the enrollment period. If you withdraw before completing more than 60% of the term, you may be required to repay a portion of the grant funds to your school or the federal government. This is called a Return of Title IV Funds calculation.

Q: How does being an independent student affect my financial aid for an online degree?

A: Being classified as an independent student on the FAFSA (which is common for adult online learners) generally increases your eligibility for need-based aid. Your aid eligibility is based solely on your own income and assets (and your spouse’s, if married), not your parents’. This often results in a lower Student Aid Index and a higher Pell Grant award.

Q: Are there specific scholarships for online associate degrees in healthcare or IT?

A: Absolutely. Many professional associations and industry groups offer scholarships to encourage entry into high-demand fields. Examples include the American Health Information Management Association (AHIMA) Foundation for health IT or the CompTIA Association of IT Professionals for information technology. Search by your specific intended profession.

Q: Is the FAFSA process different for online students versus on-campus students?

A: The application process is identical. You use the same FAFSA form and website. The key difference is ensuring that the school codes you list correspond to accredited online programs eligible for federal aid. The financial aid office at your chosen online school will then use your FAFSA data to create your package, just as they would for a campus-based student.

Securing online associate degree financial support requires a proactive and layered approach. Begin with the FAFSA to unlock federal and state resources, then aggressively pursue scholarships and employer benefits. Use loans judiciously as a final bridge, and leverage every available tax advantage and cost-saving strategy. By systematically combining these resources, you can invest in your education and future career with confidence, minimizing financial stress and building a solid foundation for long-term success. The investment of time you make now in researching and applying for financial support will pay dividends throughout your educational journey and beyond.