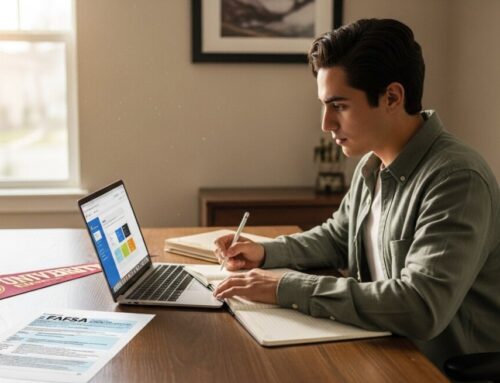

Earning an associate degree online is a powerful step toward career advancement and higher education, but the cost can be a significant barrier for many students. Fortunately, the Free Application for Federal Student Aid (FAFSA) is not just for traditional, on-campus students at four-year universities. It is a critical tool for online learners as well, opening the door to federal grants, work-study programs, and low-interest loans that can make your educational goals financially attainable. Understanding how to navigate FAFSA aid for an online associate degree is the first, and most important, step in funding your education without overwhelming debt.

Eligibility for FAFSA with Online Associate Programs

The foundational question for any prospective student is whether their chosen program qualifies for federal financial aid. The good news is that the delivery method, online or on-campus, is largely irrelevant to the U.S. Department of Education. What matters is the institution’s accreditation and its participation in the federal student aid programs. To be eligible for FAFSA aid, your online associate degree must be offered by a school that holds accreditation from an agency recognized by the U.S. Department of Education. This is non-negotiable. Attending a non-accredited institution means you cannot receive federal grants or loans, and your degree may not be recognized by employers or other colleges should you wish to transfer.

Beyond the school’s status, you must meet the standard federal eligibility criteria. This includes being a U.S. citizen or an eligible noncitizen, having a valid Social Security number, and maintaining satisfactory academic progress once enrolled. A key point for online students, especially adult learners, is that you do not need to be a full-time student to qualify. Federal aid is available for students enrolled at least half-time, which for most associate programs is typically 6 credit hours per semester. This flexibility is crucial for those balancing work, family, and studies. For a detailed walkthrough of eligibility specifics, our resource on completing your FAFSA form for online associate degree financial aid provides a step-by-step breakdown.

Types of Financial Aid Available Through FAFSA

Submitting the FAFSA unlocks several types of financial assistance, each with its own terms and conditions. It is essential to understand the differences, as this knowledge directly impacts your long-term financial health.

First, and most desirable, are grants. These are need-based awards that do not have to be repaid. The Pell Grant is the primary federal grant for undergraduate students, and the award amount is determined by your Expected Family Contribution (EFC), now known as the Student Aid Index (SAI), your cost of attendance, and your enrollment status. Many students pursuing an online associate degree, particularly those with lower incomes, will qualify for a Pell Grant, which can significantly offset tuition costs. Second, the Federal Work-Study program provides part-time jobs for undergraduate students with financial need, allowing them to earn money to help pay education expenses. While logistics can be more complex for fully online students, some schools offer remote work-study positions.

The third component is federal student loans. Unlike grants, these must be repaid with interest. However, federal loans offer benefits not typically found with private loans: fixed interest rates, income-driven repayment plans, and potential loan forgiveness programs. For associate degree students, the main loan type is the Direct Subsidized Loan, where the government pays the interest while you are in school at least half-time. Direct Unsubsidized Loans are also available, but interest accrues immediately. It is vital to borrow only what you absolutely need. As you explore your financial options, seeking clear college degree information can help you understand how different programs align with your career goals and budget.

The FAFSA Application Process for Online Students

The process of applying for FAFSA aid for an online associate degree is identical to that for any other student, but attention to detail is paramount. The application cycle opens on October 1st each year for the following academic year. You should apply as early as possible, as some aid is awarded on a first-come, first-served basis. You will need to create an FSA ID, which serves as your legal electronic signature. Gathering your necessary documents beforehand streamlines the process: your Social Security number, federal tax information (or your parents’ information if you are a dependent), records of untaxed income, and a list of the schools you are considering. Crucially, you must add the school codes for every online college you are applying to, even if you have not yet been accepted.

When filling out the FAFSA, your status as an online student does not require any special designation. You will provide the same financial and personal information as any other applicant. After submission, you will receive a Student Aid Report (SAR) summarizing your data. Each school you listed will then use this information to prepare a financial aid offer, often called an award letter. This letter outlines the types and amounts of aid you are eligible to receive at that specific institution. It is imperative to compare these offers carefully, looking not just at the total amount but at the mix of grants versus loans. Our guide on how to use FAFSA for financial aid on online associate degrees delves deeper into interpreting these award letters and making informed decisions.

Maximizing Your Aid and Avoiding Common Pitfalls

To ensure you receive the maximum aid for which you qualify, a proactive approach is necessary. First, never assume you won’t qualify. Many factors are considered in the need calculation, and you may be eligible for aid even if your family income seems high, especially if multiple family members are in college. Always complete the FAFSA. Second, be meticulous with accuracy. Errors or omissions can delay your application and reduce your aid eligibility. Double-check all entered numbers against your tax documents. Third, understand the cost of attendance (COA) for your chosen online program. This includes not just tuition, but also fees, books, supplies, and potentially a budget for a computer and internet access. Your financial need is calculated as COA minus your SAI, so a clear understanding of the full cost is essential.

Avoid these common mistakes that online associate degree seekers often make:

- Missing State and Institutional Deadlines: The federal FAFSA deadline is generous, but states and individual colleges have much earlier deadlines for their own grants and scholarships. Research and mark these dates immediately.

- Overlooking School-Specific Aid: Many online colleges offer their own institutional scholarships or grants. Often, completing the FAFSA is a prerequisite for being considered for these funds.

- Borrowing More Than Needed: It can be tempting to accept the full loan amount offered. Remember, this is debt that must be repaid with interest. Only borrow what is necessary to cover your educational expenses.

- Failing to Reapply Each Year: FAFSA eligibility is not automatic. You must submit a renewal application every year you are in school to continue receiving aid.

Finally, use the FAFSA as a gateway to other aid. Its data is often used to determine eligibility for state-based aid and is a common requirement for many private scholarship applications. Treat it as the cornerstone of your entire financial aid strategy.

Frequently Asked Questions (FAQs)

Q: Is FAFSA aid for an online associate degree different from aid for a campus-based program?

A: No, the aid types (Pell Grants, Direct Loans, Work-Study) and the application process are identical. Eligibility is based on the student’s financial need and the school’s accreditation, not the program’s delivery format.

Q: Can I use FAFSA money to pay for a computer or internet for my online classes?

A: Yes, but indirectly. Your school’s calculated Cost of Attendance (COA) should include allowances for these expenses if they are required for your program. Your total financial aid package, including loans, can be used to cover these allowable costs included in the COA.

Q: I work full-time. Will my income disqualify me from FAFSA aid for an online associate degree?

A: Not necessarily. The FAFSA formula considers many factors beyond just income, including family size and the number of family members in college. Many working adults qualify for federal student loans, and some may still qualify for need-based grants. You should always complete the application.

Q: Do I have to be enrolled full-time to receive FAFSA aid?

A: No. To receive federal Direct Loans, you generally must be enrolled at least half-time (typically 6 credits for undergraduate programs). Pell Grant amounts are adjusted based on your enrollment intensity, so you can receive a partial grant for less-than-full-time enrollment.

Q: What happens if I withdraw from my online associate degree program after receiving FAFSA aid?

A> This is a serious consideration. If you withdraw before completing more than 60% of the payment period, you may be required to repay a portion of the federal aid you received. This is called Return of Title IV Funds. Always consult your school’s financial aid office before withdrawing to understand the financial implications.

Securing FAFSA aid for your online associate degree demystifies the financial path to your education. By understanding the eligibility requirements, navigating the application process with care, and strategically using the aid offered, you can invest in your future without incurring debilitating debt. The key is to start early, be thorough, and actively manage your financial aid throughout your academic journey. Your associate degree is an investment, and with the right planning, it is an investment that pays for itself many times over.