Earning an online associate degree is a powerful step toward career advancement and higher earning potential, but the question of how to pay for it can feel daunting. The good news is that a wealth of financial resources exists specifically for students pursuing higher education, including those in accredited online programs. With strategic planning and a thorough understanding of the options available, funding your online associate degree is an achievable goal that doesn’t have to leave you buried in debt. This guide will walk you through the essential steps, from federal aid to employer benefits, providing a clear roadmap to make your educational investment financially sustainable.

Understanding Your Financial Aid Eligibility

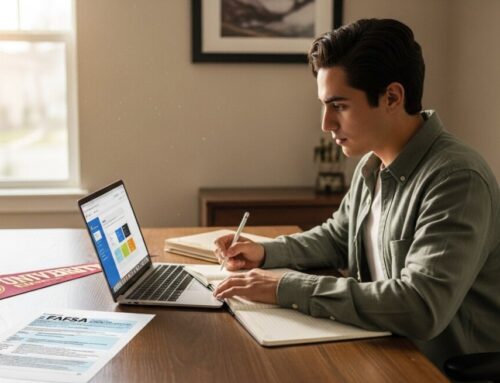

The first and most critical step in funding your online associate degree is completing the Free Application for Federal Student Aid (FAFSA). This single form is your gateway to the largest pool of financial aid, including federal grants, work-study programs, and low-interest loans. Many students mistakenly assume they won’t qualify for aid based on their income or because they are studying online, but this is often a myth. Federal aid eligibility extends to students enrolled in accredited online associate degree programs, provided the school participates in federal aid programs. The FAFSA uses a formula to calculate your Expected Family Contribution (EFC), now called the Student Aid Index (SAI), which determines your need. It’s crucial to submit the FAFSA as soon as it opens (October 1 for the following academic year) to maximize your chances of receiving aid, as some funds are awarded on a first-come, first-served basis. For a detailed breakdown of requirements, our resource on financial aid eligibility for online associate degrees provides further clarification.

Exploring Grants and Scholarships: Free Money First

Your primary focus should always be on securing “free money” that you do not need to repay: grants and scholarships. Grants are typically need-based, while scholarships are often awarded for merit, specific talents, or demographic criteria. The Pell Grant is the cornerstone federal grant for undergraduate students with exceptional financial need, and it can be applied directly to your online associate degree costs. Many states also offer their own grant programs for residents attending in-state schools, including online institutions. Scholarships require more proactive searching but are abundantly available from sources like your chosen college, private foundations, community organizations, and professional associations. When searching, use specific keywords related to your field of study, background, hobbies, and career goals. A dedicated hour each week for scholarship applications can yield significant returns. Remember, even small scholarships add up and reduce the amount you may need to borrow.

Navigating Federal and Private Student Loans

After exhausting grants, scholarships, and personal savings, student loans can help bridge the remaining gap. It is vital to understand the hierarchy and terms of different loan types. Federal student loans, such as Direct Subsidized and Unsubsidized Loans, should always be your first borrowing choice due to their fixed interest rates, income-driven repayment plans, and potential for forgiveness. Subsidized loans are particularly advantageous because the government pays the interest while you are in school at least half-time. Private student loans from banks, credit unions, or online lenders come into play only after maximizing federal options. They often have variable interest rates and lack the flexible repayment and forgiveness options of federal loans. If you must use private loans, shop around, compare rates and terms meticulously, and consider a creditworthy cosigner to secure a better rate. Borrow only what you absolutely need, keeping your future monthly payments in mind relative to your expected post-graduation income.

Maximizing Employer Tuition Assistance

One of the most overlooked resources for adult learners is employer tuition assistance (TA) or reimbursement programs. Many companies invest in their workforce’s education to build skills and retain talent. These programs typically cover a certain amount of tuition costs per year, often with the requirement that you maintain a minimum grade and that the degree is relevant to your job or the company’s business. The process usually involves getting pre-approval from your human resources department before enrolling in a course. The financial benefit is substantial: not only does it reduce your out-of-pocket cost, but the IRS allows employees to exclude up to $5,250 per year in employer-provided educational assistance from their income. If you are currently employed, reviewing your company’s benefits handbook or speaking with HR could unlock a key funding stream for your online associate degree.

Budgeting and Cost-Saving Strategies for Online Students

Effective funding isn’t just about finding money, it’s also about minimizing expenses. Online students have unique opportunities to control costs. Start by creating a detailed budget that includes all program costs: tuition, fees, books, supplies, and technology needs. Then, implement these cost-saving strategies:

- Choose an In-State Public College: Public institutions often charge significantly lower tuition for state residents, even for their online programs, compared to out-of-state or private colleges.

- Investigate Flat-Rate Tuition: Some online programs offer a flat-rate tuition per term, allowing you to take more credits for the same price and potentially graduate faster.

- Use Open Educational Resources (OER): Many professors use free, high-quality OER textbooks and materials, which can save you hundreds of dollars per course.

- Leverage Prior Learning Assessment (PLA): Earn college credit for knowledge gained from work experience, military service, or certifications through exams like CLEP or DSST, reducing the number of courses you need to pay for.

Sticking to a budget requires discipline, but the long-term financial payoff of graduating with less debt is immense. For a step-by-step walkthrough of the application process that unlocks many of these funds, refer to our guide on how to apply for financial aid for your online associate degree.

Frequently Asked Questions

Can I get financial aid if I’m only attending online school part-time?

Yes, you can. While you must be enrolled at least half-time to qualify for certain types of aid like Direct Subsidized Loans, part-time students are still eligible for federal Pell Grants (with adjusted amounts) and other aid. Always check with your school’s financial aid office for specific enrollment requirements.

Do I have to pay back grants?

Generally, no. Grants are considered gift aid and do not need to be repaid, provided you meet all the eligibility requirements and complete your enrollment period. However, there are circumstances, such as withdrawing from school early, that might require you to repay a portion of a federal grant.

How does my choice of major affect financial aid?

For most federal and state aid, your major does not affect eligibility. However, many private scholarships and some institutional grants are specifically targeted toward students in certain fields of study. Choosing an in-demand field may open doors to more specialized scholarship opportunities.

What if my financial situation changes after I submit the FAFSA?

You can contact your school’s financial aid office to request a professional judgment review. If you or your family experiences a significant change in income (e.g., job loss, high medical bills), the financial aid administrator may adjust your data, which could potentially increase your aid eligibility.

Are there specific scholarships for online students?

Yes, a growing number of scholarships are designated specifically for distance learners. These are offered by online universities themselves, as well as by organizations that support non-traditional and adult education. Thorough research using databases that filter for “online students” is key.

Successfully funding your online associate degree is a multifaceted process that combines leveraging federal systems, hunting for scholarships, exploring employer benefits, and practicing smart financial planning. By approaching it systematically, you can invest in your future without compromising your financial stability. The journey begins with the FAFSA and continues with proactive research and budgeting. Remember, this degree is an investment in yourself, and with the right financial strategy, its returns will far outweigh the costs. For those still exploring their options, comprehensive college degree information can help you understand the full landscape of academic pathways before committing to a specific funding plan.